SBP chief says use of RMB to fortify Pakistan-China economic ties

Gwadar Pro

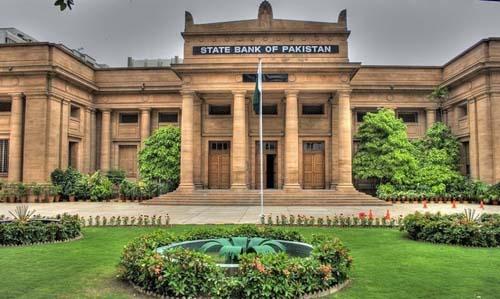

Islamabad: Governor State Bank of Pakistan (SBP) Jameel Ahmad said this week that employing the Chinese Renminbi (RMB) for cross-border trade and investment transactions could further fortify Pakistan-China economic ties.

Addressing an event themed “Promoting the use of RMB in Cross-Border Settlement,” organized by China’s ICBC Bank here, Governor SBP Jameel Ahmad underscored the robust and enduring economic and financial connections between Pakistan and China.

He stressed that employing the Chinese Renminbi (RMB) for cross-border trade and investment transactions could further fortify these ties.

This event celebrated ICBC Bank’s designation as the RMB clearing agent in Pakistan by the People’s Bank of China (PBoC).

The Governor SBP elaborated on the significance of Pakistan’s economic relations with China and emphasized that the SBP had established the necessary regulatory framework to facilitate the use of RMB in trade and investment activities.

This includes actions like opening Letters of Credit (L/Cs) and accessing financing facilities in RMB.

He pointed out that, within Pakistan’s regulatory landscape, RMB stands on equal footing with other global currencies, such as the US Dollar, Euro, and Japanese Yen.

Both public and private sector entities in Pakistan have the liberty to opt for RMB in their bilateral trade and investment dealings, he added.

Thanks to the SBP’s endeavors to promote the use of RMB in trade with China, RMB-denominated imports from China have risen significantly, surging from approximately 2% in FY18 to around 18% in FY22, he maintained.

Governor SBP also discussed the advantages of a local RMB clearing system and conducting trade transactions in RMB.

“These benefits encompass a swift turnaround time and cost reduction for the local banking system, simplified access to RMB settlements, improved and more competitive pricing for bilateral trade, and the opening of new markets for Pakistani businesses,” he mentioned.

He reiterated the SBP’s unwavering commitment to providing policy and regulatory support to bolster economic and financial ties with China, ultimately benefiting consumers and businesses from both nations.